The art of creating something out of nothing. Or at least trying to.

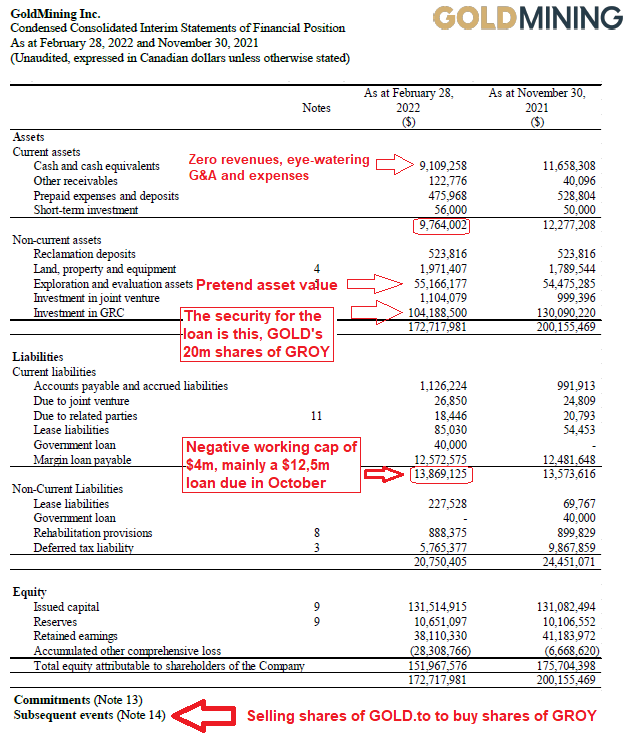

For those that can remember back that far, GoldMining Inc (GOLD.to) was built on the idea of scooping up unbuildable and unworkable gold assets that had been through the 43-101 system and come out the other side with officially recognized resources. It didn’t matter to Amir Adnani that projects such as Titiribi in Colombia, La Mina in Colombia, Cachoeira in Brazil, Crucero in Peru etc had failed miserably to get off the ground and the companies controlling them had collapsed in a heap, all he cared about was the flashy gold number, signed off by some hired geology team at some point. Since then, Adnani has spun Gold Royalties out of GOLD.to and, by the power of corporate wheelin’n’dealin’, grown a royalty company out of nothing. However, once you go back and look at the present state of GOLD.to it’s quite a thing to see what the company’s supposed equity value is dependent upon. As seen above, these days GOLD.to runs a negative working capital. That’s due to the margin loan it took out with BMO last year:

Notice the security for that loan, it’s the 20m shares of GROY…rather interesting in context, as you’ll see. Anyway, as at end Feb’22 GOLD.to had only used half of that loan facility because, despite having zero revenues or income, GoldMining Inc has found an alternative way of raising treasury via selling more shares to market through a newly inaugurated ATM facility. But even more interesting is the way it’s using the begged and borrowed funds, because…

…GOLD.to has decided to prop the share price of the only thing it has of apparent value. The current block purchases of GROY are also oddly timed, as GROY is trying to convince Elemental Royalties (ELE) shareholders that its hostile bid for their company is in their best interests. And while all to no avail so far GROY is rather insistent, even extending the deadline again yesterday in order to give ELE holders more time to think about it. Strange how the serial snake Garofalo and his pervy sidekick Alan Hair haven’t managed to win them over, innit? Anyway, I digress, let’s get back to GOLD.to because when you start looking at the other things the company does with its cash pile…

…you can’t accuse the company of neglecting C-suite expense accounts or scrimping on office budget. Surely they’d be better off buying something of real value, instead of blowing their wad on the day-to-day fripperies of executive mining life, because once anyone with a memory takes a look at what have compared to what they claim as asset value…

…it becomes more apparent as to why GOLD.to is sweating so much on the GROY share price and so keen on propping it up. There are other dubious assets on that list, but you only have to see how nearly half of the E+E Asset value is tied up in two projects with a history of value destruction, due to the way they are both uneconomic and utterly unpermittable (let alone being in Colombia, fast becoming the worst major S.Am country to go mining).

Long story short (pardon the pun), after building something from nothing the current GOLD business plan is to sell paper to market and use that cash, plus a BMO loan facility secured with GROY shares… to buy GROY shares! The plan seems to involve propping its own asset value and that of GROY’s share price in order to convince ELE shareholders that GROY equity is an attractive alternative. Now all this isn’t exactly Ponzi-level yet, but it’s the living breathing example of the corporate creaking edifice and what’s more, the way GOLD.to is blowing treasury on “general expenses” smacks of a C-suite trying to make as much hay as possible while the sun still shines upon their corner offices. It begs the question as to whether BMO approves of the way GOLD is allocating its funds, inquiring minds, etc…

[…] to prop the other highly overvalued company in its stable by buying shares in Gold Royalty (GROY). As we pointed out in this recent post, the shady financial tricks being played in the background of this company are almost too blatant, but as the target audience […]