Considering that Deborah Honig of Adelaide Capital has been paid many tens of thousands of dollars over many years to keep investors aware of Excellon Resources (EXN) and in that time has conducted no end of webinar interviews and promotions for the company, there’s no better person to ask for expert opinion and insight. So with that in mind and considering…

- EXN’s next debt servicing installment on its C$17.91m loan is due paid in four weeks’ time

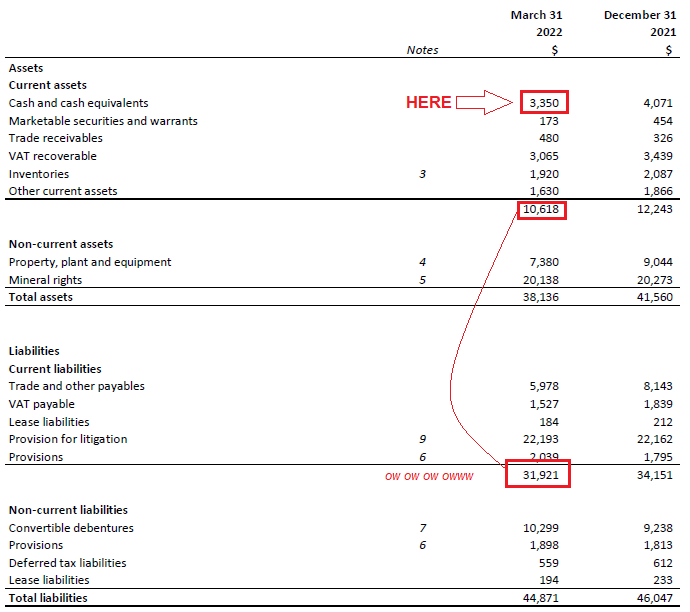

- There’s a distinct lack of liquidity and working capital at the company

- EXN has the option to pay its debt servicing either in cash or shares

- In every other occasion the interest servicing was due, EXN paid in shares (also from the recent 1q22 financials)

….we’d like to know her opinion on these questions:

- Does she think EXN will honour its June 30th debt servicing in cash or shares?

- If in shares, how many does she estimate they will need to emit*?

- If EXN eventually settles using shares, does she think the creditor will hold them, or sell them immediately?

- Does she think the current EXN share price offers a good entry point for retail investors?

*FWIW, the house guess is around 1.25m

That difficult IR moment when the numbers become more important than the words.