Find below the full text of Marin Katusa’s pump to his flock on Lucara Diamond Corp (LUC.to), dated February 26th 2018, which included such wonderfulness as:

“This is THE Most Important Alert I Have Ever Sent”

“I will be making this one of my largest bets ever”

“I have never asked you stop whatever you are doing to read one of my reports or alerts, but I am asking you now.”

“With Clara, Lucara is ridiculously cheap, and should be in everyone’s portfolio.”

“I am prepared to buy my first tranche as high as CAD$2.60 per Lucara share.”

Even by the standards of this charlatan and snake oil salesman, Katusa’s prose was breathless in the extreme. It was also total bollocks, as

your humble scribe pointed out in this post a day later. Katusa’s pumpjob (read it yourself below) was so full of holes it was almost juvenile, far too easy to point out the flaws.

Added to that, IKN later went on to explain the real reason LUC.to was so keen on getting the full Katusa Massage-With-Happy-Ending treatment

in this post dated June 19th (TL:DR, it needs to raise cash very soon, else its main mine is going bye-byes). It’s also worth mentioning that Katusa got desperate on this trade and pumped it hard at least two more times this year (who remembers the July 4th malarkey?). And now, finally after many attempts from those that artificially prop markets to defend the line, LUC.to this week dropped under the $2.00 level and that’s important, because this desk understands that a whole bunch of people holding the stock on margin are going to get a phone call tomorrow morning due to that line being broke. They won’t like what they hear, either. Anyway, check out the 12 month price chart action in LUC.to here, then read Katusa’s purple prose and decide for yourself.

Publisher’s Note: Due

to an unexpected web server issue, our website was down this morning.

Of course, it had to happen at a crucial time to coincide with when we

sent this alert. Below you’ll find the body of the alert in the Members

Area. |

|

Total Disruption: This is THE Most Important Alert I Have Ever Sent

Over the last fifteen years there has been only one major technological disruption in resource sector: Fracking.

And it completely changed the global oil and gas industry.

Today’s alert will be the second major technological disruption.

OPEN DISCLOSURE: In

48 hours, after KRO subscribers have had a chance to buy their first

tranche, I and funds that I am associated with will be making this

recommendation a cornerstone investment in the portfolio and buying in

the open market. I plan on making this investment comparable to Alterra

in size in my portfolio (in value of dollars invested).

I

take incredible pride in being the first person in the world to write

about what I believe will be an industry changing technology that will

completely turn an industry upside down (in the same way that fracking

turned the oil and gas industry upside down—and made the early investors

a fortune). And more importantly, this will provide everyone an

incredible way to profit from this opportunity before the big hedge

funds, banks and smart investors catch onto what you will know within 30

minutes of reading this report.

Right

now, I am on the road writing this to you from my hotel room and we

will complete a full comprehensive research report on this company, but

we felt at the current market price, it was necessary to get the alert

out to you.

This is an industry that operates in almost absolute secrecy…

Yet, it’s 22 times the size of the uranium market.

This secretive, almost family cartel industry is almost 20 times the annual size of all the global lithium market.

As

crazy as this sounds, this one industry is bigger than Manganese,

tungsten, uranium, cobalt, lithium, molybdenum, platinum, palladium,

tin, lead, bauxite, and silver combined.

It’s almost twice the size of zinc and five times the potash sector.

Not

surprising, Warren Buffett is heavily involved and has made a fortune

from this sector, albeit quietly. And remember this – and you heard it

first – Amazon will eventually be involved in a big, big way (but more

on that in the full research report) and enter this sector in the coming

years.

How did I uncover such a secretive sector?

I

met the former chairman of the global council of this industry almost a

decade ago. Then, in 2011, he asked me to go through all the financial

statements of his privately held corporations to evaluate his business

based on my thoughts. So I put together a report for him.

He runs a global enterprise with thousands of employees.

After

signing an Non-Disclosure Agreement and pouring over his empire’s

financial statements, I was given an inside understanding of this

secretive, +$80 Billion per year global industry that few outsiders ever

get the opportunity to see. I learned the closely guarded ins and outs

of this utterly secret industry from one of its largest industry titans.

Today, for the first time ever, I will share with you everything I know about this incredible opportunity.

Investment Recommendation:

BUY Lucara Diamond Corp. (LUC.TO on the Toronto Stock Exchange, LUCRF on the US listing)

Lucara is a stock I have been watching for years.

It

is one of the highest margin (i.e. most profitable) mines in the world,

and easily one of the most valuable diamond mines in the world.

The company pays a 4.6% dividend.

Lucara has no debt and a very strong balance sheet.

Lukas Lundin owns ~30% of the company.

And most importantly…

Lucara just purchased 100% of Clara Diamond Solutions Corp., which I believe will turn out to be one of the most valuable acquisitions in mining ever. Lucara has just positioned itself as the center of chessboard within the lucrative diamond industry.

Clara

uses proprietary analytics together with cloud and blockchain

technologies to modernize the existing diamond supply chain, driving

efficiencies and ensuring diamond provenance from mine to finger. This

is a technological breakthrough that ensure diamond integrity,

transparency and tracking across the entire diamond supply and value

chain.

I will be making this one of my largest bets ever and plan on making it one of my core holdings for many years to come.

I

have never asked you stop whatever you are doing to read one of my

reports or alerts, but I am asking you now. As this report is that

important. And I believe that looking back on this, many years from now…

it will be looked upon as one of the most significant reports I have

ever written in my career.

This is one of the most exciting opportunities I have ever seen, and the company is currently cheap at its current share price.

The Diamond Industry is about get the Mother of all Disruptions

This is an industry that few understand, yet the polished diamond annual market is an annual +$80 Billion per year market.

It’s

an industry that hasn’t changed much in the last 100 years. Yes, you

heard that right. Of all the sectors in the economy, the diamond sector

has changed the least in the last 100 years.

The Past:

Cecil

Rhodes’ incredible ambition in consolidating and expanding his reach

within the diamond fields of Africa eventually became DeBeers after his

untimely death due to heart disease. At the turn of the 20thCentury,

DeBeers had a monopoly on the three main areas of the global diamond

market: production, sorting and sales. DeBeers also singlehandedly

created a market for these diamonds within the U.S. markets.

We’ve all seen the marketing, “A Diamond is Forever”, “A Woman’s Best Friend”, and of course, we’ve all heard “You should spend three months salary on a diamond engagement ring”.

But

the most brilliant part of DeBeers business plan wasn’t their marketing

(although it’s probably the best product marketing ever). Rather, it

was how they sold their products.

Let me explain how DeBeers was structured in the past…

DeBeers controlled the global diamond market by controlling the diamond selling market.

There were three ways DeBeers got their diamonds.

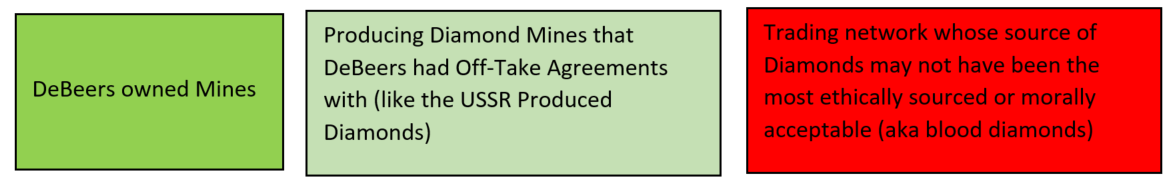

I

think it’s fair to say that DeBeers historically got their Diamonds

from three “sources” officially called the Central Selling Organization

(or CSO) within the industry. |

|

That box in red is red for a reason.

What

was incredible is how DeBeers combined the diamonds from the CSO and

then sold the rough diamonds to only DeBeers selected “site holders”

who had to be pre-approved by DeBeers. For 100 years, a “Site Holder”

was the equivalent as being guaranteed a profit within the diamond

pipeline. Even today there are less than 100 “site holders”.

Site

Holders were extremely private and didn’t want to lose their status

with DeBeers in any way. Simply put, it was their livelihood, so the

site holders played by DeBeers’ rules.

DeBeers would package the Diamonds into parcels called Boxeswhich would be pre-allocated to each of their “site holders” specific needs and requests.

Here was the genius of a “DeBeers Box”…

Let’s use some simple numbers to illustrate my example.

If

there were 30 rough diamonds in a box, the site holder buying the rough

diamonds from DeBeers could only manufacture at most 2/3rds of the

rough diamonds at a profit using their available manufacturing

techniques.

The

remaining 1/3 (or in most cases, many more) of the rough stones would

not be produced by the manufacturer buying the box of rough diamonds and

they would be stored and hopefully be sold later in the secondary rough

diamond market.

And

very few site holders would ever reject a DeBeers box in fear that they

would lose their “site holder” status. Because even if you got a bad box

from DeBeers, at least you got a box, and you didn’t need to source

your diamonds from the secondary markets.

This was the secret to DeBeers strategy.

DeBeers

controlled the rough product that was sold into the market, and by only

releasing enough rough diamonds to each manufacturer, they created a

massive secondary market for diamonds without getting involved in any of

those transactions.

The

secondary market for Diamonds is massive. There are thousands of

manufacturers who are looking for rough diamonds to meet their own

manufacturing demand.

You

see, everything up until this point has focussed on the “rough

diamond”, before it gets cut and polished into its specific “final”

jewellery characteristics.

Things changed for

DeBeers when the USSR collapsed. Up until this time, the Soviets even

sold their diamonds into the DeBeers controlled CSO.

The

combination of the Collapse of the Iron Curtain, the end of apartheid

in South Africa and the discovery of mines outside of Africa (mainly

Canada and Russia), DeBeers’ absolute control over the diamond industry

came to an end towards the end of the 20th Century.

Fast Forward to the Present

DeBeers

is still the largest player today in the diamond sector (by $

value)—but they aren’t the only players as they once were in the past.

70% of the global output of diamonds come from only 15 mines.

80% of the global production of rough diamonds come from 6 producers.

One of the worlds largest mining companies, Rio Tinto, produces about 5% of the worlds rough diamonds (by $ value).

What

was once owned by the Soviet Union, and is now essentially owned by

Alrosa and the Russians, make up about 25% of the global $ value of

rough diamond production.

Russia, Botswana, and Canada are three largest diamond producing nations.

For the most part, the whole industry has continued to use the old DeBeers sales model—and that’s because it’s worked so well.

The

problem DeBeers always had with their inventory is how to sell a

diamond they knew wasn’t “ideal” to their site holders but knew it would

be ideal for some other manufacturer down the industry pipeline.

That

was the genius of the “site holders” sales process set up by DeBeers. I

am repeating this because its such an important aspect to the

disruption that is going to happen to the diamond industry.

Let’s go back to my example earlier.

In

a box of 30 diamonds, maybe 20 at most would be “ideal” to that

specific site holder. The site holder was most likely a manufacturer or

jeweler who wanted the 20 of the 30 diamonds, but had to buy all 30.

Thus, he had to buy all 30, and figure out what to do with the 10 rough

diamonds that he knew were “non-ideal” to his manufacturing set up and

sales chain.

The site

holder knew he would at best break even on the 10 diamonds he didn’t

want, but his focus was on maintaining his site holder status with

DeBeers and, more importantly, making money on the 20 diamonds that were

ideal to his production and manufacturing chain, which would cover the

10 diamonds that his manufacturing and sales chain wasn’t ideal for.

Thus,

a secondary market was created within the industry. This does not exist

in copper, gold or any other commodity. It is specific to diamonds,

because each diamond is so unique.

This was where the thousands of buyers who do not have DeBeers site holder status get access to buying rough diamonds.

The

secondary market is where the site holders would repackage their

undesired diamonds (because it didn’t work with their manufacturing)

into their own “boxes” and sell to other diamond buyers (which could be

wholesalers, manufactures, jewellers, etc.)

This is the way rough diamonds have sold for over 100 years.

It didn’t matter if you were an American buyer, Russian, Indian or Chinese buyer.

The

“DeBeers Model” of selling in “boxes” to their site holders was copied

by the Russians and the other major producers of rough diamonds.

Unfortunately

for the producers, the sales happened in what are known as “sites” and

they happen every 5-6 weeks. At every site, the producer would package

up their rough diamonds into “boxes” or what is nothing more than a

package of a wide assortment of diamonds that buyers can “bid” on the

boxes.

The Problem With The Model

The

DeBeers model created a lot of inefficiencies for the producers (the

seller of rough diamonds) because the revenue became very lumpy. And the

producers know they aren’t getting best price for their diamonds

because only a small sample set of all buyers of rough diamonds were

actually present for the “sales” of the rough diamonds.

On

the other end of the rough diamond spectrum… the rough diamond

producers were the manufacturers, who took a rough diamond and cut and

polished the diamond.

The

DeBeers sales model was extremely inefficient for the buyers (the

manufacturers) of the rough because anywhere between 35% to 80% of the

rough diamonds in the box were not ideal to the manufacturing process of

that specific buyer who had the right to the DeBeers site.

Because

there are so many different ways (designs) a specific rough can be cut,

depending on the design and the sales distribution stream a specific

manufacturer has—the exact same rough diamond will be valued differently

by every manufacturer because their ultimate sale price is different

than every other manufacturer or jeweller’s sale price.

Because

there are so many different types of designs for diamonds, the

optimized value for a specific stone may never actually get achieved

because that specific rough diamond isn’t in the hands of the right

manufacturer.

Also,

every manufacturer has their own patented designs and cuts and

advantages and disadvantages for each specific rough diamond.

For

example, an Indian manufacturer may specialise and have an advantage on

a specific style of finished cut and polished diamond when compared to

another manufacturer in Israel or China based on the sales distribution

line.

Hence, every rough diamond in the world has an ideal manufacturer for the stone.

The question is, will the stone find its appropriate manufacturer in the DeBeer “box’ sales system?

No.

Rough

diamonds can be sold and traded up to 25 times before they find their

eventual manufacturer (or find its eventual “wheel” as its described in

the industry, the “wheel” being the diamond cutters wheel in polishing

the diamond).

The Complete Solution

What if rather than the archaic DeBeers process of selling “boxes”, the manufacturers could buy only the rough they need?

This was never an option until today.

Due

to computing power and technology of scanning rough diamonds, the

manufacturers’ desired final diamond design can be run through a very

complex but quick and accurate algorithm. And every rough diamond gets

scanned and can be matched with the ideal manufacturer who will maximize

the “polished” diamond value.

No more buying rough you don’t want.

No more secondary markets.

No more unwanted inventory, and high financing carrying costs.

A Game Changing Technology

Lucara is going to change the whole diamond industry.

That’s why I am so bullish about the potential of Clara, which is now owned 100% by Lucara.

This recommendation will not only be one of my largest positions ever but will be one for many years to come.

Let me explain.

Its

rare, if ever, that one can get exposure to a real-sector disruption

technology this early without buying a dream with considerable risk.

This is why Lucara is such an incredible buy at current prices.

If Lucara didn’t purchase Clara (the revolutionary disruptive technology), the company is currently cheap at current prices.

With Clara, Lucara is ridiculously cheap, and should be in everyone’s portfolio.

Lucara has an incredible balance sheet, no debt and has one of the highest margin mines in the world.

By the way, the new management team, led by Eira Thomas is the 0.01% of the resource industry.

Eira

is the mastermind of acquiring Clara. In fact, Eira was the mastermind

in acquiring Karowe, the world class mine that is 100% owned by Lucara.

But it was Lukas Lundin that backed Eira’s theory to become a reality.

Lukas, Catherine and Eira created

Lucara (get it, Lu- for Lukas, Ca for Catherine, and Ra-for Eira)

Diamond Corp in 2007. Since then, the company has and will continue to

dividend out hundreds of millions of dollars to shareholders. My goal is

to own 1% of Lucara.

Let me just make a Segway here for a moment about why this management team is the top 0.01% of the resource deal.

Nobody in the resource sector has the track record comparable to Eira Thomas has. I repeat. No one.

Not even my favorite people in mining like Lukas or Ross Beaty. And readers know I hold them in very high regard.

In

a career spanning 25 years, Eira’s track record is four for four. This

means she has made a major success of each company by either selling for

a big gain for shareholders or the project went into production.

Two

world class discoveries, one being one of the largest most valuable

mines ever (Diavik), another a mine that is producing now (Stornoway),

the current mine that we are going to benefit from (Karowe) and then

there was the gold company that Eira and the team spent 24 months with

and then sold to the worlds third largest gold producer (Kaminak).

Three of those major success (all over $1B hits) were in Diamonds, hence why Eira is known globally as the Queen of Diamonds.

But Clara Diamond Solutions is where Lucara has incredible upside.

A

mine is expensive to build. And almost all of those costs are upfront.

Then you mine the asset for 10-20 years to not just get your money back

and hope to make a profit for shareholders.

Eira

has been brilliant in being the first to recognizing the value and

potential of a project. For example, the total acquisition price Eira

acquired Karowe for has already been paid out in dividends to

shareholders. More importantly, Lucara has already paid back all the

costs of building the mine.

Eira knows mining and comes from a successful mining family.

Clara

is not just going to be used by the miners of rough diamonds, but also

as existing inventory within the manufacturing base. And countries that

have state owned diamond companies like in Namibia will see the value

chain is improved about 23%. And Clara will clip its fee on every diamond that goes through the platform.

Owning this company is like owning as mall piece of every fracked well in North America.

That’s what we’re getting with Lucara’s disruptive technology – a piece of every diamond.

Obviously,

we want to buy the stock as cheap as possible, but I think buying the

shares anywhere below CAD$2.25 is a very good buy. I am prepared to buy

my first tranche as high as CAD$2.60 per Lucara share.

I am very excited about the potential of this company.

-Marin