…which is sad and wonky I know. Here are two charts that say to me “does not compute”. This one shows the latest LME warehouse number, as up, up, up she goes.

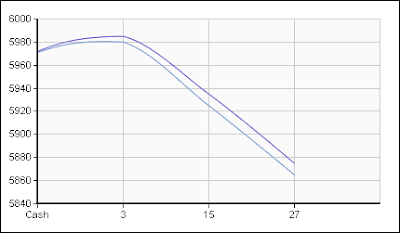

This one shows the futures curve at the LME, with traders unafraid to be net long.

The only logical solution to this (

as far as my limited neurons carry me, anyway) is that copper is a direct “weak dollar” play right now and screw the fundamentals. But the thing is, fundies will out in the end; they always do. If you’re still bullish here that’s ok but be careful and be specially ware of those bulls with very loud mouths and “100% certain” opinions on commodities at the moment. As far as I can see the complex is slave to the whims of the monetary markets, not who is or is not using metals. If the dollar decides to reverse and appreciate away from its current downmove (

it wouldn’t take much in the way of news in this skittish market) people will suddenly pay a lot of attention to that LME warehouse number as it continues its relentless limb.

All imho, dyodd, dude.