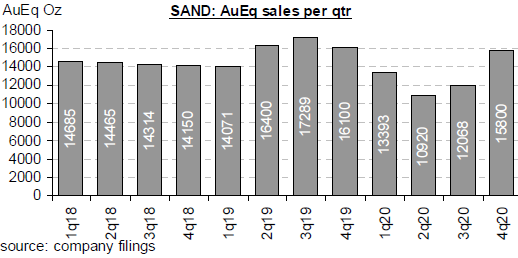

Better late than never, and better than this desk expected, the Sandstorm Gold Royalties (SAND) (SSL.to) 4q20 sales NR hit Monday morning and, as your humble scribe no longer holds the stock (sold the second half of a long-term position at some point in 2020) let’s run charts here on the blerg, starting with AuEq sales:

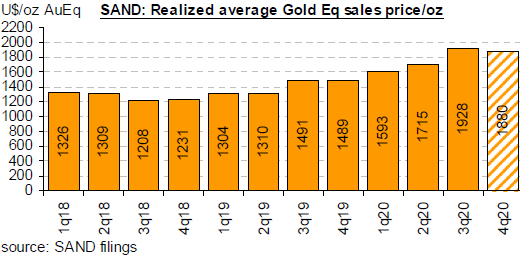

That’s a good quarter, better than my 14k guesstimate and shows you what I know. Here’s average received prices per quarter:

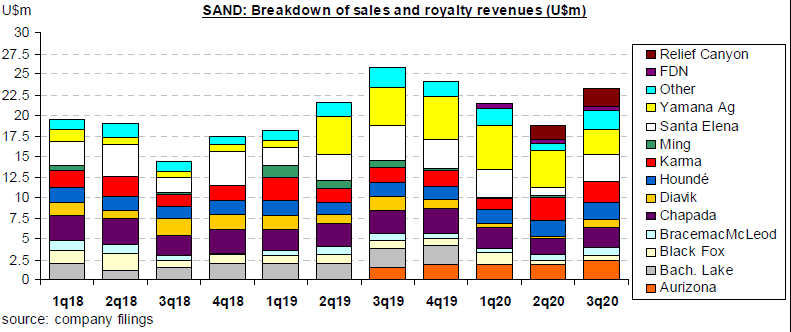

And here’s revenues:

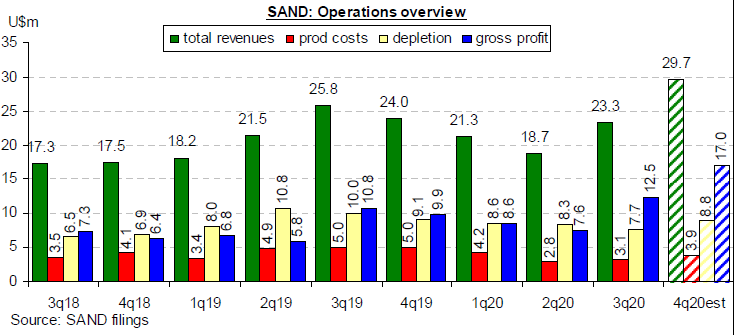

The better than expected AuEq sales number and the on-market average received price means SAND came in with preliminary revenues of U$29.7m, beating the house target of U$26.6m handily. As for why the beat, a look at the revenues breakdown from previous quarters can provide insight, we’ll get the breakdown for Q4 when SAND reports its year.

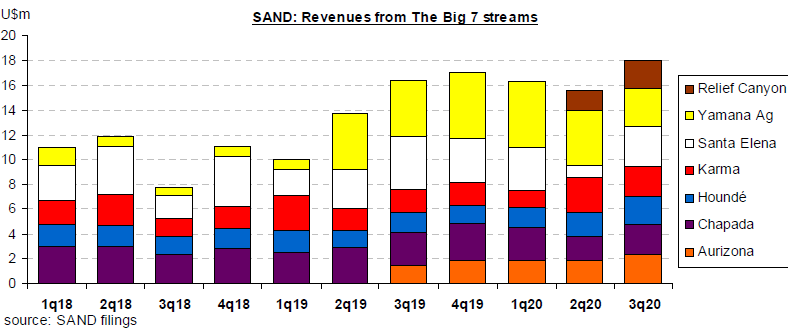

We can also home in on the “big seven” streams at SAND to see how Q3 came in compared to previous quarters. For me, the beat will have origins in better revenues from the Yamana silver stream, the new Fruta del Norte (FDN) royalty and Relief Canyon getting into gear.

Cash costs sans DD&A at U$3.9m was slightly hotter than the house U$3.5m estimate and when we make our reasonable guesstimate for the obligatory non-cash item controlled by a host of third party companies and not much to do with SAND, here’s another chart:

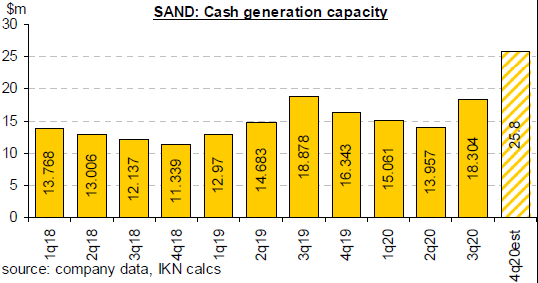

Even the GAAP gross profit of U$17m, or 8.8c per share, looks good. But the real proof of concept at SAND is its cash generation ability, the fair yardstick is to ignore the non-cash items and see how how money it can drive to treasury (or to other projects) per quarter:

That’s a strong quarter by any metric, 13.4c per share, which means the selling we’ve seen since Monday is unlikely to be company-specific.

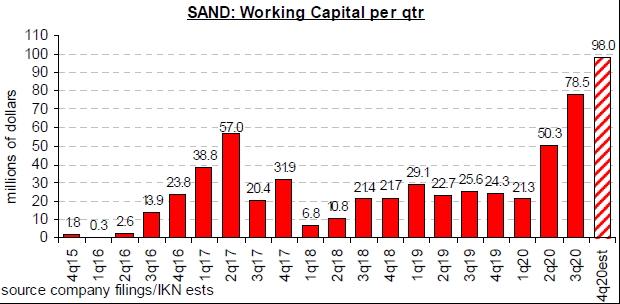

As for what the quarter means to the company’s financials, here we’re going with just a couple of charts. The assets and liabilities at SAND have/have not a revolving loan component from time to time, its other advantage as a company is that it doesn’t need to hold much hard cash in treasury to maintain corporate liquidity, so rather than all the balance sheet charts the easy way of checking financial health is the working capital position.

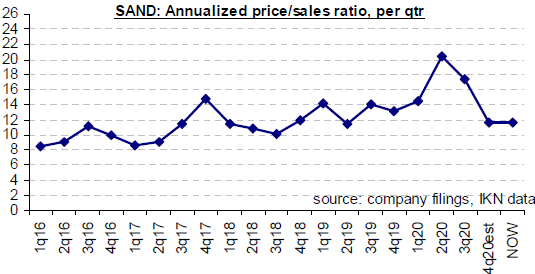

SAND looks ever stronger financially, I’d expect them to continue to suck up to Wall St and keep buying back stock. Meanwhile, the strong results quarter combined with the weak price performance means SAND is back to a buyable level on key metrics, for example price/sales.

However, the longer-term performance isn’t anything to do with the somewhat tardy but strong rebound delivered by SAND this quarter. It’s more about larger, strategic reasons because the streamer sector is a sell this year, the whole edifice is overvalued. So dump your Ely, Metalla and Franco-Nevada too, a cruel dose of financial reality is about to hit the sub-sector, its disruption long overdue.

I’m curious, if you don’t mind, on your expanding a bit on your last paragraph. What makes you think the streaming sector is going to change? Is it that a longer term commodity market + increase in the POG will open up more traditional financial markets to the mining industry? That an increase in the POG will make the margins of a streamer over a miner less important?

https://monetary-metals.com/monetary-metals-issues-worlds-first-gold-bond-since-1933/

Gold Bonds are back!